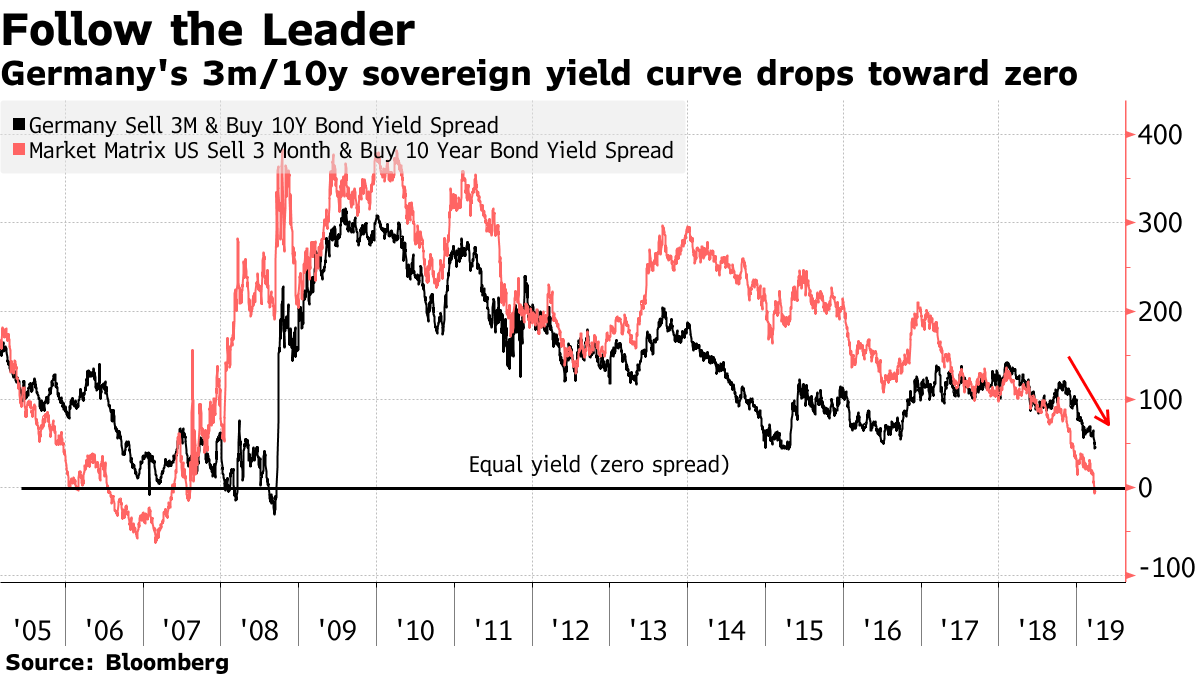

Holger Zschaepitz on Twitter: "Now the German yield curve is flattening to a post-crisis low following US. Yield gap between 10y and 3mth notes has halved this year. But w/ 3mth yield

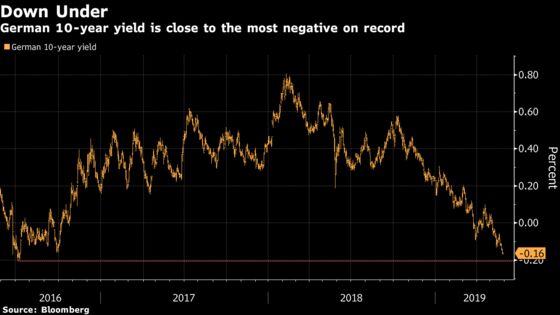

Holger Zschaepitz on Twitter: "Totally absurd: #Germany sold new 10y Bund w/no coupon for 1st time since 2016. Investors paid record yield of -0.26% to lend Germany money. Neg yield means investors

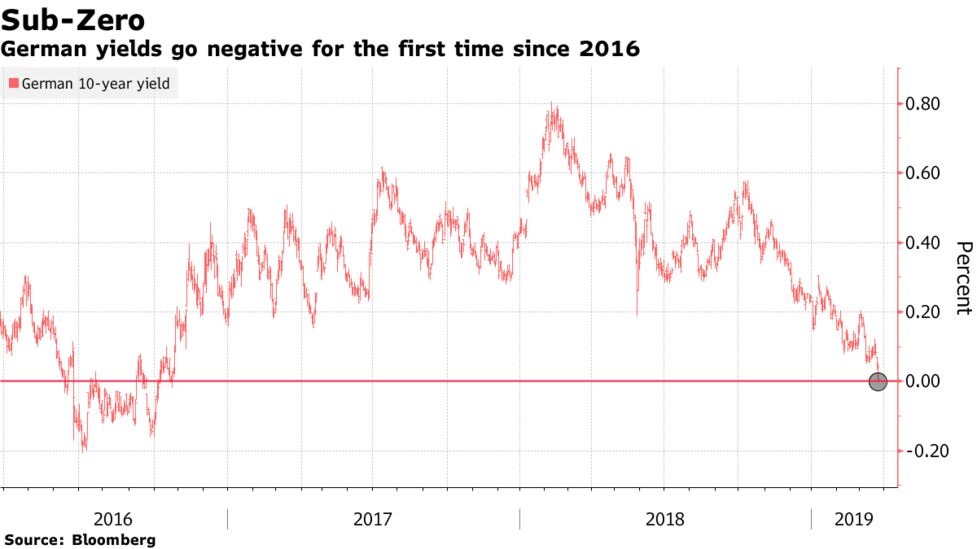

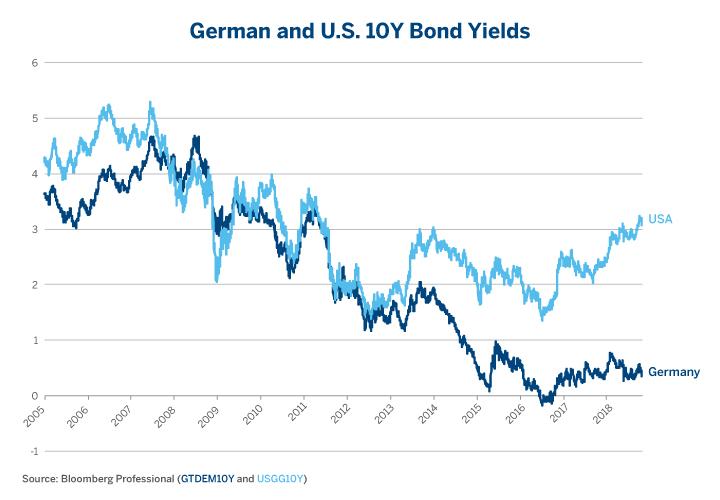

Holger Zschaepitz on Twitter: "#Japan & #Germany are in a race to the bottom. Germany is again in the lead w/ 10y Bund yields at -0.07% while 10y JGB yields at -0.05%.…

Bloomberg Markets on Twitter: "German bund yield drops to record, Commerzbank says 0% possible https://t.co/LsyXx5oDbB via @aragaomarianna… "